Hi, I'm Leland...

I help female entrepreneurs and nonprofit leaders implement automation that gives them their time and sanity back

even if they’ve been stuck doing it all themselves.

Hi, I'm Leland...

I help female entrepreneurs and nonprofit leaders implement automation that gives them their time and sanity back

even if they’ve been stuck doing it all themselves.

How Can I Help you a.i.m.?

(a.i. automation Marketing)

Expert Custom A.I. Solution

Do you need help implementing A.I. into your business?

Read My Book

New to the world of A.I., automation, and marketing? Start with the fundamentals. My beginner-friendly book breaks down complex tech into plain language so you can confidently build your foundation without overwhelm.

take A course

You’ve dabbled with AI tools—but now it’s time to go deeper. Learn how to integrate automation into your workflows, marketing, and operations with step-by-step courses designed to boost productivity and revenue.

1-on-1 Coaching

You already use AI in your business. Now it’s time to optimize, delegate, and scale. Work with me 1-on-1 to audit your systems, refine your strategy, and create seamless automation that frees your time and boosts profit.

EXPERT

LET'S BUILD IT

You’re not looking for another tool—you need a tailored solution. I’ll architect and implement an end-to-end AI system specifically designed for your business model, team, and growth goals. Think smarter, move faster, and lead the future.

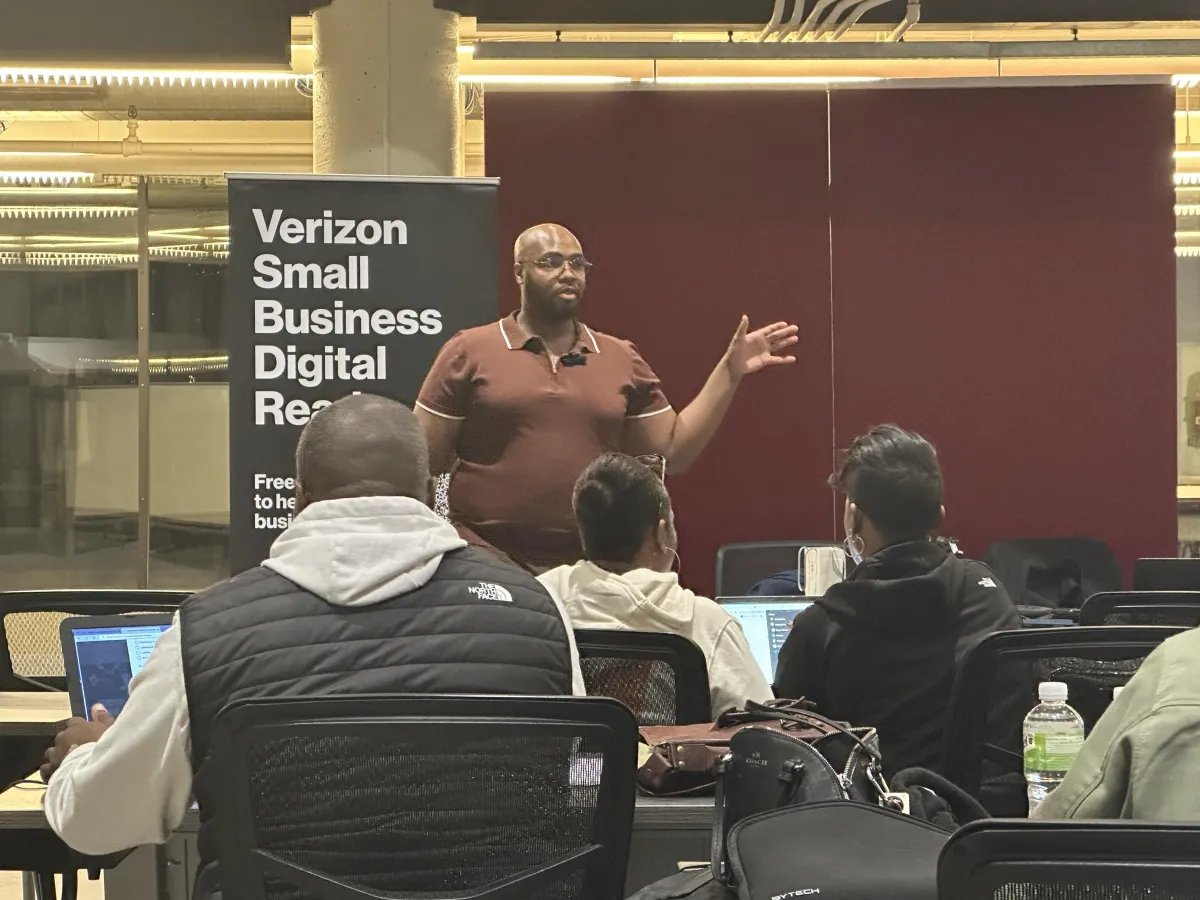

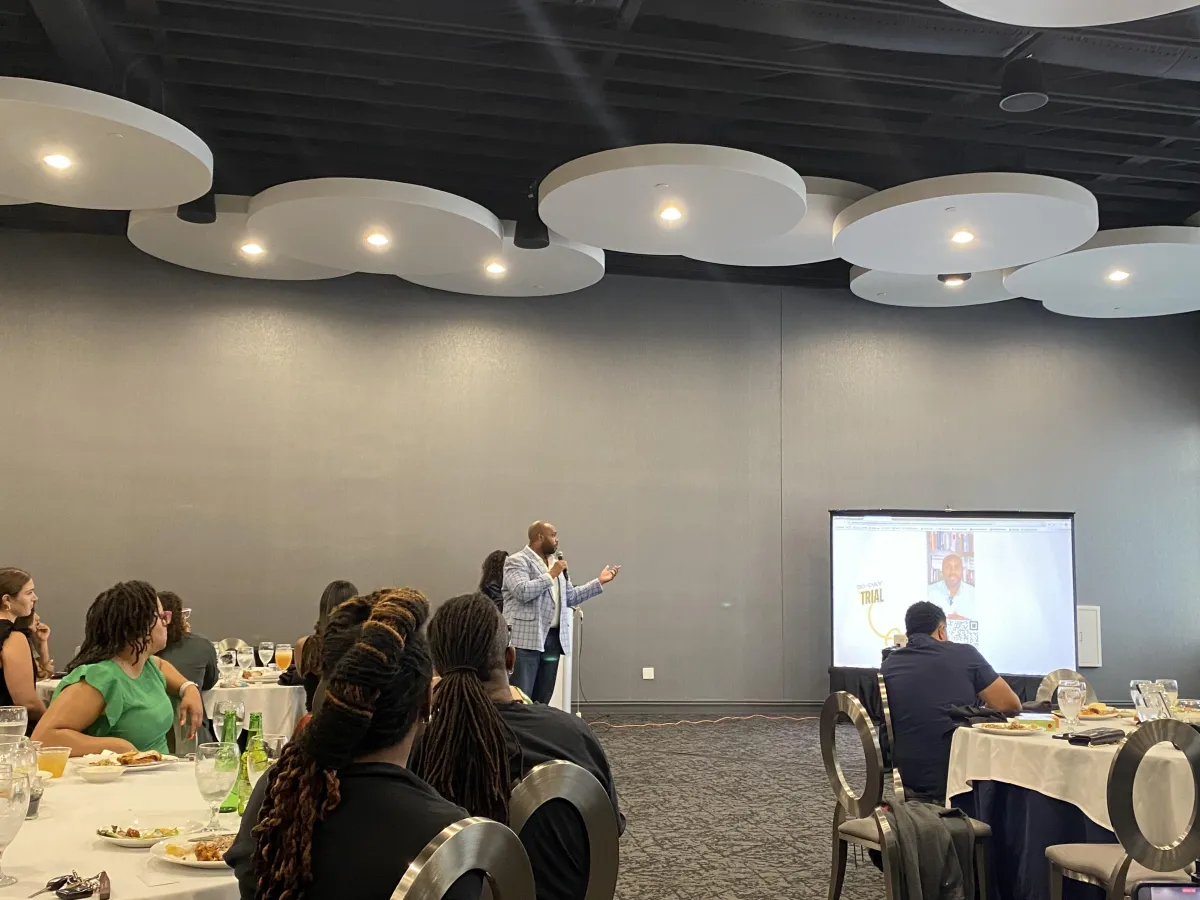

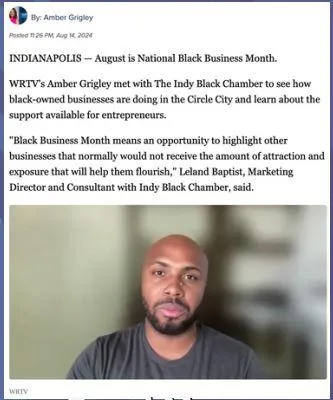

As seen in:

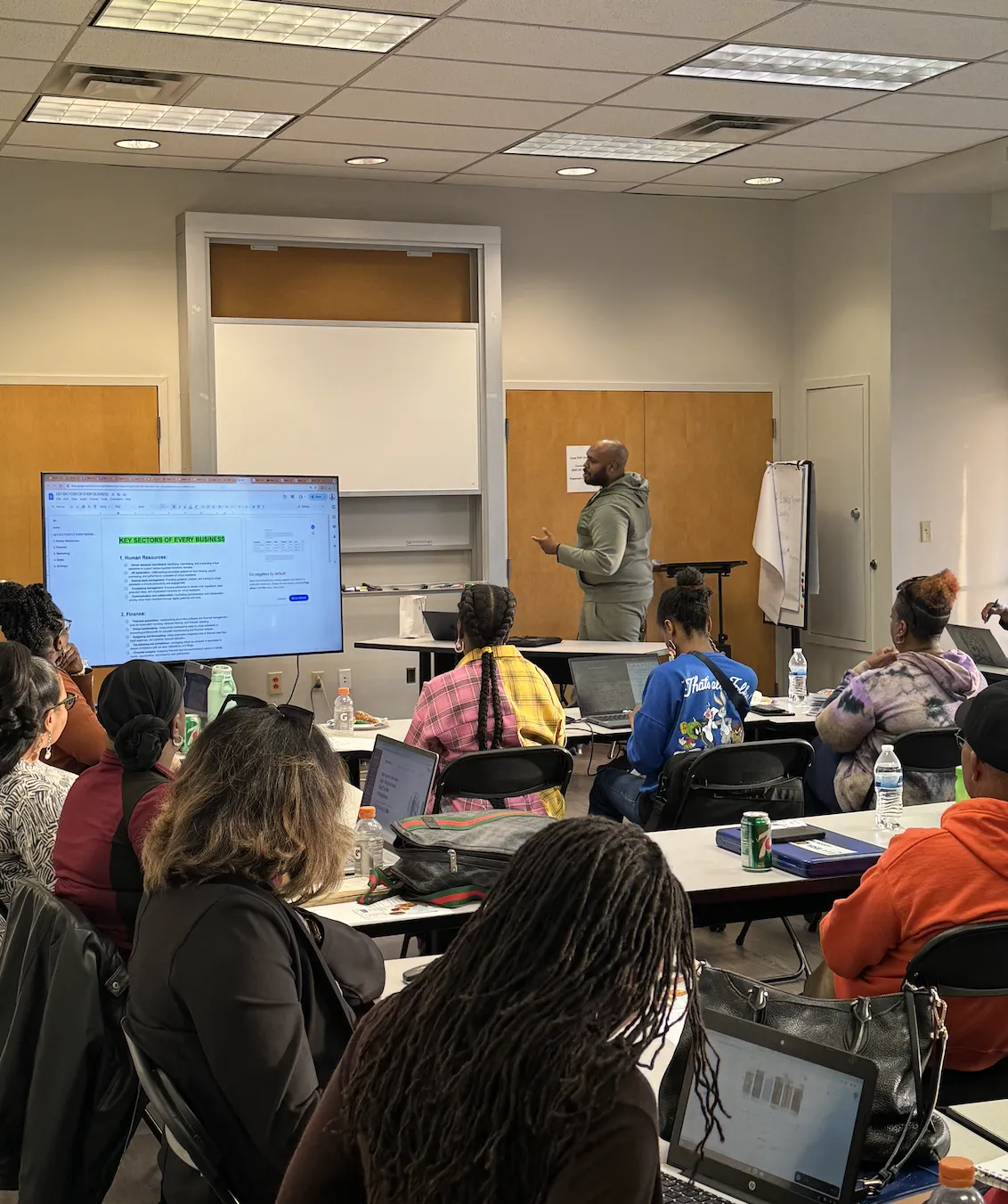

I'VE SUCCESSFULLY empowered 200+ SMALL BUSINESSES INTO HIGH POWERED A.I. SYSTEMS AUTOMATION AND MARKETING

Choose your own adventure below:

Systems + A.I. = scale

“I went from overwhelmed and overworked to automated and in control.”

“Before working with this system, I was juggling everything—emails, follow-ups, client onboarding—and burning out fast. In just a few weeks, I had automated processes in place that saved me hours every day. Now I have more time for my family, and my revenue has doubled. This blueprint changed the game for me.”

Are you ready to scale?

Choose a coaching package to get started.

Don't know where to start? Start With This Free 5-Day Challenge...

THE 5-DAY PEACE & PROFIT BLUEPRINT

Daily Bite-Sized Wins:

Each day delivers one simple but powerful system to help you reclaim your time.

Peace of Mind:

Eliminate chaos by installing processes that run quietly in the background.

Profit-Ready Systems:

Build automation that works even when you’re offline—with no tech overwhelm.

Bonus:

Includes 30 days of Ignite Business Software FREE to fast-track your results.

Automate 80% of your business in 5 days or less without hiring a big team or burning out.

Inside the Blueprint:

Day 1: Organize Your Offers & Onboarding in Minutes

Day 2: Create Your Automated Lead Capture Flow

Day 3: Follow-Up Like a Pro—Without Lifting a Finger

Day 4: Install a Simple Sales System That Works 24/7

Day 5: Set Up Your “Invisible Team” with Automation Tools

“This free blueprint helped me systemize more in 5 days than I had in 5 months. I finally feel in control.”

— Happy User of Ignite Business Software

Ready to Trade Chaos for Clarity?

Grab the 5-Day Peace & Profit Blueprint + 30-Day Software Trial

"Most business owners have no problem selling their genius. The problem is they’re trapped doing all the work. Leland's Team will install the systems that free you up starting with your time, then your tech, then your team."

Read the book, now checkout the

COURSES TO HELP YOU GROW

Upgrade your skills, sharpen your systems, and unlock faith-fueled, AI-powered growth—on your terms.

faith for business 1.0

Align your faith and your business with practical teachings that help you lead, sell, and scale with integrity and purpose. This isn’t just mindset—it’s marketplace ministry in motion.

The Ultimate Interactive AI Marketing Guide

Discover how to attract, engage, and convert leads using real-time automation and AI-powered tools. This hands-on guide walks you through smart systems that do the heavy lifting for you.

The Business scale Growth Engine

The Systems-Based Path to Predictable Revenue

From lead gen to fulfillment, this course helps you build a business that runs smoother, sells faster, and serves better with less stress and more structure to scale.

Walking the talk...

CLIENT SUCCESS STORIES

“I felt like Leland was inside my brain. These tools helped me finally breathe again in my biz.”

– Tasha R.

“I was scared of tech and automation. This bundle made it feel EASY and like I actually have control again.”

– Danielle M.

“I closed 3 new clients after setting up ONE of the workflows from this! Game-changer.”

– Melissa J.

Want to kick your business into high gear?

Choose Your Coaching Path Below

Done-With-You or Done-For-You—Either Way, You’re Scaling Smarter, Not Harder.

Done-With-You Coaching

Done-For-You Automation

Guided Support, Hands-On Help, Real Progress

Benefit: Get expert guidance and accountability as you build your AI-powered systems—with personalized feedback every step of the way.

Feature: Weekly coaching calls, AI automation templates, and marketing systems tailored to your business.

$297 / month

Skip the Learning Curve—We’ll Build It for You

Benefit: Your automation system is built, tested, and launched by experts—so you can stay focused on running your business.

Feature: Includes full system setup, funnel creation, AI implementation, and ongoing optimization.

$3,997+ / month

Done With You

Here's a subheadline to backup the primary headline.

- Benefit: Our products are delivered immediately

- Feature: Explain the benefit of your products

- Icon: Change the icons in the settings

$497 / month

Done For You

Here's a subheadline to backup the primary headline.

- Benefit: Our products are delivered immediately

- Feature: Explain the benefit of your products

- Icon: Change the icons in the settings

$1997 / month

Copyright © 2025 LelandBaptist.com | All Rights Reserved.

Facebook

Instagram

X

LinkedIn

Youtube

TikTok